Stress Testing Your Portfolio: POAH’s Look at Stressors and Mitigation Strategies Amidst COVID-19

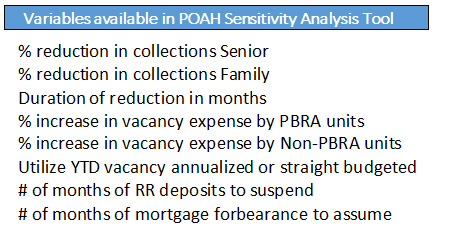

COVID-19 has crept into every corner of the economy and affordable housing organizations, like millions or other businesses and organizations around the country, have already and will be impacted further by this crisis. As we began to grapple with the new and uncertain reality of COVID-19, we set out to evaluate the potential impacts of COVID-19 across our 11,000+ unit portfolio to understand the range of possible outcomes, communicate predictions to our board and partners, and evaluate mitigation strategies to inform next steps. We considered many stressors on the POAH portfolio and mitigation strategies as further detailed below. In doing so, we developed an excel model that we are making available here and sharing with industry colleagues at LISC, CHAM, SAHF, HPN and NHRA in hopes that it may prove helpful to peers contemplating similar questions.

While the question of what to model will be unique by property, portfolio and other demographic considerations (i.e. tenancy, geography, location type, loan type, lender, syndicator, etc.), we found significant value in creating an iterative model so we can apply different assumptions as new realities unfold and slice across all these dimensions. Numerous stressors came to mind when considering impacts of COVID-19 on the portfolio.

Stressors of Greatest Concern

- Tenant receivables/delinquency

- Prolonged vacancy

- Professional cleaning costs if residents or staff contract COVID

Additional Stressors for Consideration:

- Cleaning supplies & PPE

- Maintenance staff overtime

- Reduced Management Fees

- Growing bad debt & legal expense

- Deferred maintenance

- Certification challenges

- Tenant holdover

- Inability to evict

- Potential market instability (interest rates, tax credit rates, construction pricing, vendor viability/availability)

Ultimately, we focused our modeling on three stressors: residential delinquency, commercial delinquency and prolonged vacancy, discussed in detail below. We also evaluated the impact of professional cleaning costs, reduced management fees, and increased expenses for cleaning supplies, staff overtime, personal protective equipment, bad debt, and legal expense.

Delinquency

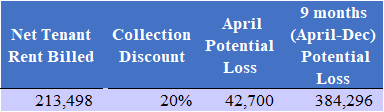

POAH took two cuts at evaluating delinquency: a quick analysis and a more nuanced look. The quick collections analysis used Tenant Rent from February, applied the portion of project-based assisted units to the rent collected and held that revenue steady, and then applied discount factors by tenancy (Family or Senior) to the remaining portion of rent. That monthly number was then applied for April through year end. For example, when we applied a 20% discount factor on tenant rent for family properties and no discount to senior  properties (since seniors are largely on fixed income) to a subset of the POAH portfolio, potential rent loss for April was estimated at $42k and equated to approximately $384k if 20% collection reduction continues through year end.

properties (since seniors are largely on fixed income) to a subset of the POAH portfolio, potential rent loss for April was estimated at $42k and equated to approximately $384k if 20% collection reduction continues through year end.

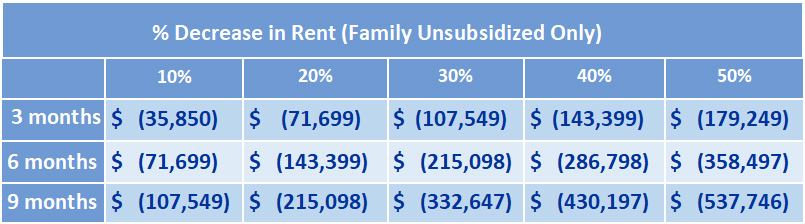

This quick analysis was helpful but it applied a discount without any consideration for if residents are protected by a tenant-based voucher. It also took the percentage of project-based units as the percentage of rent coming from project-based units, but with varying rent levels and unit types we know that this may not always be the case. In our more involved sensitivity analysis, we looked to the detailed rent roll to identify if a unit benefited from any form of subsidy (TBV or PBRA) with the assumption that rent on subsidized units is more secure given that tenants can shift all or some of their portion of the rent to HUD through interim income certifications. This allowed us to isolate unsubsidized unit rent to understa nd the dollars at greatest risk (by property). We could then apply different discount factors and durations to just the share of rent coming from unsubsidized units. We took advantage of the excel data table feature which allowed us to define two variables (% decrease in collection and number of months of decreased collection rates) so we could easily change any of our assumptions to iterate and see instant results under different collection scenarios. As the graph above shows, when looking at unsubsidized rental income only (removing tenant income where subsidized) with a 20% discount rate for the same nine-month period (April-December) and the same portfolio subset, the figure drops from $384k to $215k potential loss. Of course, this relies on the assumption that tenants can and will do timely interim certifications where they have experienced a loss of income.

nd the dollars at greatest risk (by property). We could then apply different discount factors and durations to just the share of rent coming from unsubsidized units. We took advantage of the excel data table feature which allowed us to define two variables (% decrease in collection and number of months of decreased collection rates) so we could easily change any of our assumptions to iterate and see instant results under different collection scenarios. As the graph above shows, when looking at unsubsidized rental income only (removing tenant income where subsidized) with a 20% discount rate for the same nine-month period (April-December) and the same portfolio subset, the figure drops from $384k to $215k potential loss. Of course, this relies on the assumption that tenants can and will do timely interim certifications where they have experienced a loss of income.

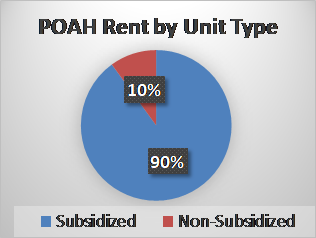

Across the POAH portfolio, we are fortunate that 90% of our rental income comes from units with rental subsidy so our greatest risk is for the remaining 10%. That said, w e are modeling how moratoriums on evictions may impact tenant payment of rent in the short term irrespective of subsidy.

e are modeling how moratoriums on evictions may impact tenant payment of rent in the short term irrespective of subsidy.

Prolonged Vacancy

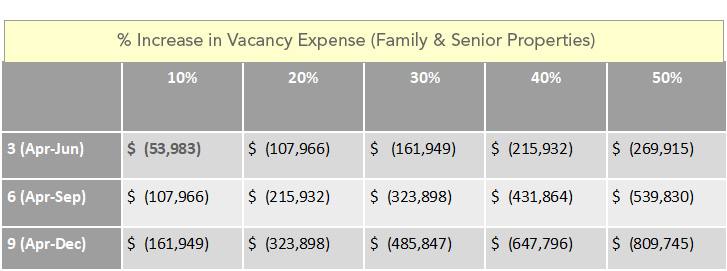

We also evaluated prolonged periods of vacancies as property managers are challenged to meet with tenant prospects, maintenance staff face constraints getting units turned and ready for leasing, and demand dampens for moving amid the crisis (on the one hand, a benefit as our residents are unlikely to move, but on the other hand, a detriment to leasing vacant units). Currently staff deemed essential employees remain working at our sites meeting residents by appointment only and performing emergency work orders solely. They will be working hard to sustain and improve occupancy, leveraging new tools like video conferencing to connect with prospective tenants and utilizing HUD’s recent guidance on income certifications. Nevertheless, we thought it important to model the impact of increases in vacancy both as compared to budgeted vacancy for the remainder of the year and/or applying an increase factor to vacancy experienced year to date.

As the graph above shows for the same subset of our portfolio, a 10% increase in the greater of budgeted vacancy or year to date vacancy by property for three months results in $54k of estimated new vacancy expense.

Mitigation Strategies

Fortunately, the stimulus bill has brought longer and more generous unemployment insurance benefits, immediate checks for low- and middle-income families, and recovery funds and loans for small businesses. We have adjusted staff responsibilities some to help resident families and commercial tenants access these supports. Further, we are confident we have a number of additional mitigation strategies to counterbalance increased accounts receivable, prolonged vacancy, or other impacts from COVID-19.

Mitigators Modeled

- Postponement of 2020 capital projects

- Suspension of replacement reserve deposits

- Utilization of operating reserves

- Mortgage forbearance

Additional Mitigators to Consider:

- Fundraising

- Increasing RR withdrawal / reliance

- Moving around subsidy at property

- Creative leasing (homeless placements, COVID-19)

- Deferral of utility, real estate tax or other payables

- Not deferring management fees (to keep parent strong)

- Guarantee and/or Covenant Relief

Capital Project Deferral

Colleagues from our property management subsidiary, POAH Communities, carefully reviewed the capital projects budgeted in 2020 and identified nearly $1 million of projects to be funded from Operations this year that we could elect to defer to offset impacts of COVID-19. We did not look to defer capital projects funded from replacement reserves but that would be another tangential strategy to consider to preserve replacement reserves so that they could potentially be utilized to cover an operating deficit.

Operating Reserves

POAH also looked at property-level operating reserve, replacement reserve and other reserve balances. For select properties, we will consider requests to utilize operating reserves for expenses and economic loss associated with the crisis. To date, in our sensitivity analysis we generally assumed operating reserves be utilized to cover outright operating deficits, not reductions in revenue or expense increases attributable to the crisis when the properties are otherwise solvent.

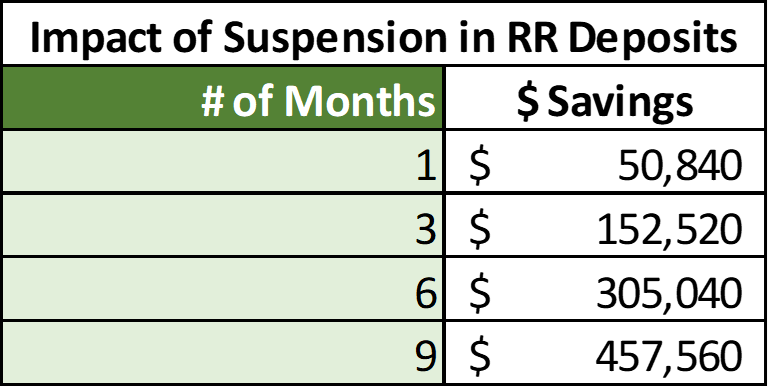

Suspension of Replacement Reserve Deposits

We are also hearing from lenders and partners that they will consider granting temporary suspension of replacement reserve deposits recognizing that much of planned capital work will not be happening this year anyhow with construction moratoriums, vendor shutdowns, quarantine / social distancing orders, and competing demands on staff time and resources. We support this mitigation strategy and think it is one of the cleanest and easiest to implement quickly. We would caution though that it will need to be papered to ensure owners do not trigger default provisions in loan or other closing documents. At the right is an example of the positive impact this strategy would have on the portfolio subset.

We are also hearing from lenders and partners that they will consider granting temporary suspension of replacement reserve deposits recognizing that much of planned capital work will not be happening this year anyhow with construction moratoriums, vendor shutdowns, quarantine / social distancing orders, and competing demands on staff time and resources. We support this mitigation strategy and think it is one of the cleanest and easiest to implement quickly. We would caution though that it will need to be papered to ensure owners do not trigger default provisions in loan or other closing documents. At the right is an example of the positive impact this strategy would have on the portfolio subset.

2019 Surplus Cash Retention

For select properties to the extent they experience a hardship and distributions have not already been made to partners and subordinate lenders, we may consider asking them to waive requirement of payments on their loans or fees from 2019 surplus cash. We applaud our partners who have already reached out to communicate this option given these unprecedented times.

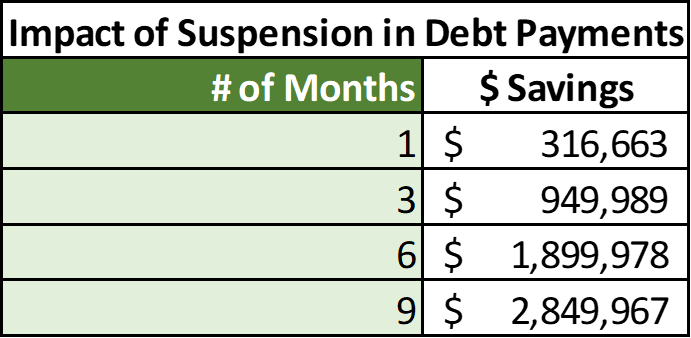

Mortgage Forbearance

The CARES Act included forbearance rights for borrowers with “federally backed’ mortgages (FHA-insured or purchased/scrutinized by Fannie or Freddie); and the Federal Housing Finance Agency (FHFA) recently announced that it will allow lenders to grant forbearance for up to three months to owners of multifamily properties who hold Fannie Mae or Freddie Mac loans. We assume other lenders will similarly consider forbearance options. However, some open questions remain: Will proof of hardship be required? What will constitute hardship? What will the duration be– 30, 60, 90 days? Does forbearance apply to interest only or all debt service? What will the repayment obligations be (if any)? Will the term extensions be permitted? Will there also be a suspension of debt service covenants and/or default provisions needed? In the graph at the right, we analyzed the gross impact of suspending debt service payments across the same subset of the portfolio. We anticipate some of the aforementioned mitigation strategies will be simper to implement but are happy to have this forbearance option to explore with partners where necessary. Additionally, we are impressed by the creativity that has emerged from lenders inventing unique new loan products to fund debt service for the year ahead as an additional solution where subordinate debt can be added (with or without consent from 1st lenders, which hopefully partners are willing to provide quickly where required).

The CARES Act included forbearance rights for borrowers with “federally backed’ mortgages (FHA-insured or purchased/scrutinized by Fannie or Freddie); and the Federal Housing Finance Agency (FHFA) recently announced that it will allow lenders to grant forbearance for up to three months to owners of multifamily properties who hold Fannie Mae or Freddie Mac loans. We assume other lenders will similarly consider forbearance options. However, some open questions remain: Will proof of hardship be required? What will constitute hardship? What will the duration be– 30, 60, 90 days? Does forbearance apply to interest only or all debt service? What will the repayment obligations be (if any)? Will the term extensions be permitted? Will there also be a suspension of debt service covenants and/or default provisions needed? In the graph at the right, we analyzed the gross impact of suspending debt service payments across the same subset of the portfolio. We anticipate some of the aforementioned mitigation strategies will be simper to implement but are happy to have this forbearance option to explore with partners where necessary. Additionally, we are impressed by the creativity that has emerged from lenders inventing unique new loan products to fund debt service for the year ahead as an additional solution where subordinate debt can be added (with or without consent from 1st lenders, which hopefully partners are willing to provide quickly where required).

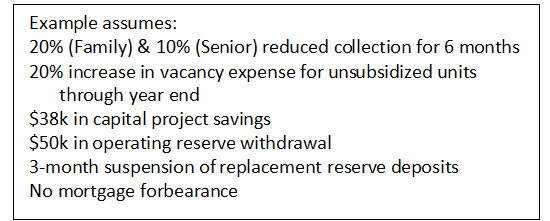

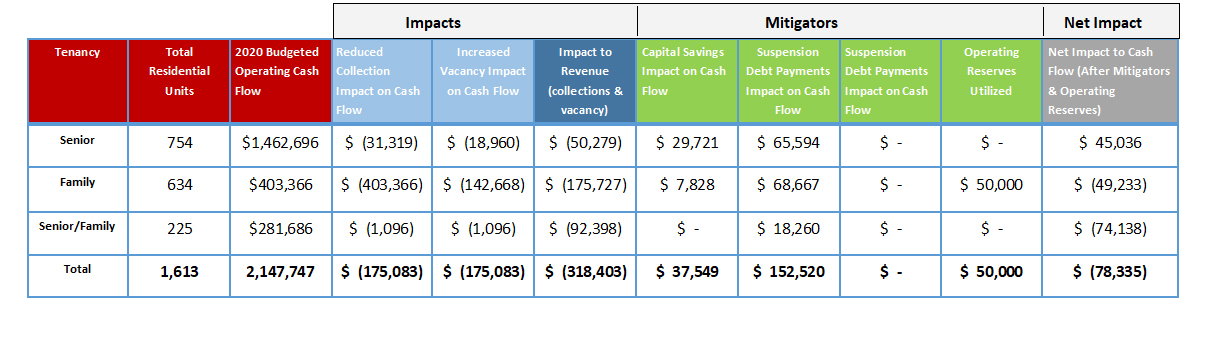

Putting It All Together

Below is a table that combines the various impacts and mitigators discussed above for the same subset of the POAH portfolio. Under the assumptions noted at the right, aggregate collection would be down $175k and vacancy expense up $143k for a total impact of ($318k). These losses could be offset by $38k savings in capital, $153k saving in RR deposits not made, and $50k in withdrawals from Operating Reserve where property deficits would result and operating reserve balances sufficient to cover them. The net effect under this scenario would be approximately $78k less in cash flow.

While the strategies we take will be nuanced on a property-by-property basis and oversight and attention to each property will be crucial, we are confident that we can work with our partners to find solutions to ensure solvency of the POAH portfolio.

While the analysis above used portfolio-wide assumptions, the excel model also allows you to create property specific overrides across multiple dimension.For example, if you have one property that is in an area that is particularly hard hit by the virus, you could set the rent collections discount factor for that property higher than you do for the rest of the portfolio.

If you are interested in checking out the Sensitivity Analysis excel model we built, it is available for download through the link below